Superior Payroll Plan For Quickbooks Desktop Customers

These range from minor inconveniences to extra vital issues that may disrupt the graceful flow of payroll processing. Understanding these potential roadblocks and having a clear plan for addressing them is crucial for maintaining accurate and well timed payroll operations. This part offers steerage and resources to navigate these challenges, transforming the digital shadows into the clear gentle of efficient payroll management. QuickBooks Payroll is well-suited for companies with multi-state payroll needs. It handles the complexities of managing payroll across different states, guaranteeing compliance with state-specific tax rules. This characteristic simplifies payroll management for companies with workers in a quantity of locations, providing peace of thoughts and decreasing administrative burdens.

QuickBooks Payroll supplies a range of assist choices, together with phone help, stay chat, and an extensive online assist center. These sources are designed to assist customers with any questions or points they might encounter while using the software. QuickBooks is understood for its glorious buyer support, ensuring that you have the help you should handle your payroll successfully. Handling employee garnishments can be complicated, however QuickBooks Payroll simplifies the process with its garnishment management function. I found this extremely useful because it automates the calculation and deduction of garnishments, making certain compliance with legal requirements. You can manage garnishments with ease, lowering the danger of errors and ensuring employees’ obligations are met precisely and efficiently.

The plan also presents project profitability tracking and stock management, allowing businesses to optimize resource allocation and manage inventory ranges successfully. With help for five users, it is well-suited for bigger teams and complicated business wants. In just 30 days, you possibly can expertise improved efficiency in running payroll, saving priceless time whereas maintaining accuracy. For these transitioning from QuickBooks On-line Payroll, the desktop product supplies a extra hands-on method, giving you larger management over your information. With an active payroll subscription, payroll users benefit from computerized tax calculations, digital payments, and timely filings.

Reactivate Your Payroll Subscription

You do not need to be a math wizard as a outcome of QuickBooks handles the heavy lifting. The calls for of this payroll titan usually are not insignificant; a sturdy machine is required to bear its weight. A steady internet connection can be crucial, as QuickBooks Enhanced Payroll 2025 incessantly communicates with Intuit’s servers for updates and tax data. Failing to fulfill these necessities may result in irritating delays and potential errors, casting an extended shadow on the effectivity of your operations. The twilight descends on the ledger, casting long shadows on the complexities of payroll. But, inside QuickBooks Enhanced Payroll 2025, a glimmer of efficiency and automation shines, providing solace to the weary accountant’s soul.

The Reason Why Quickbooks Payroll Subscription Expired Error Arises

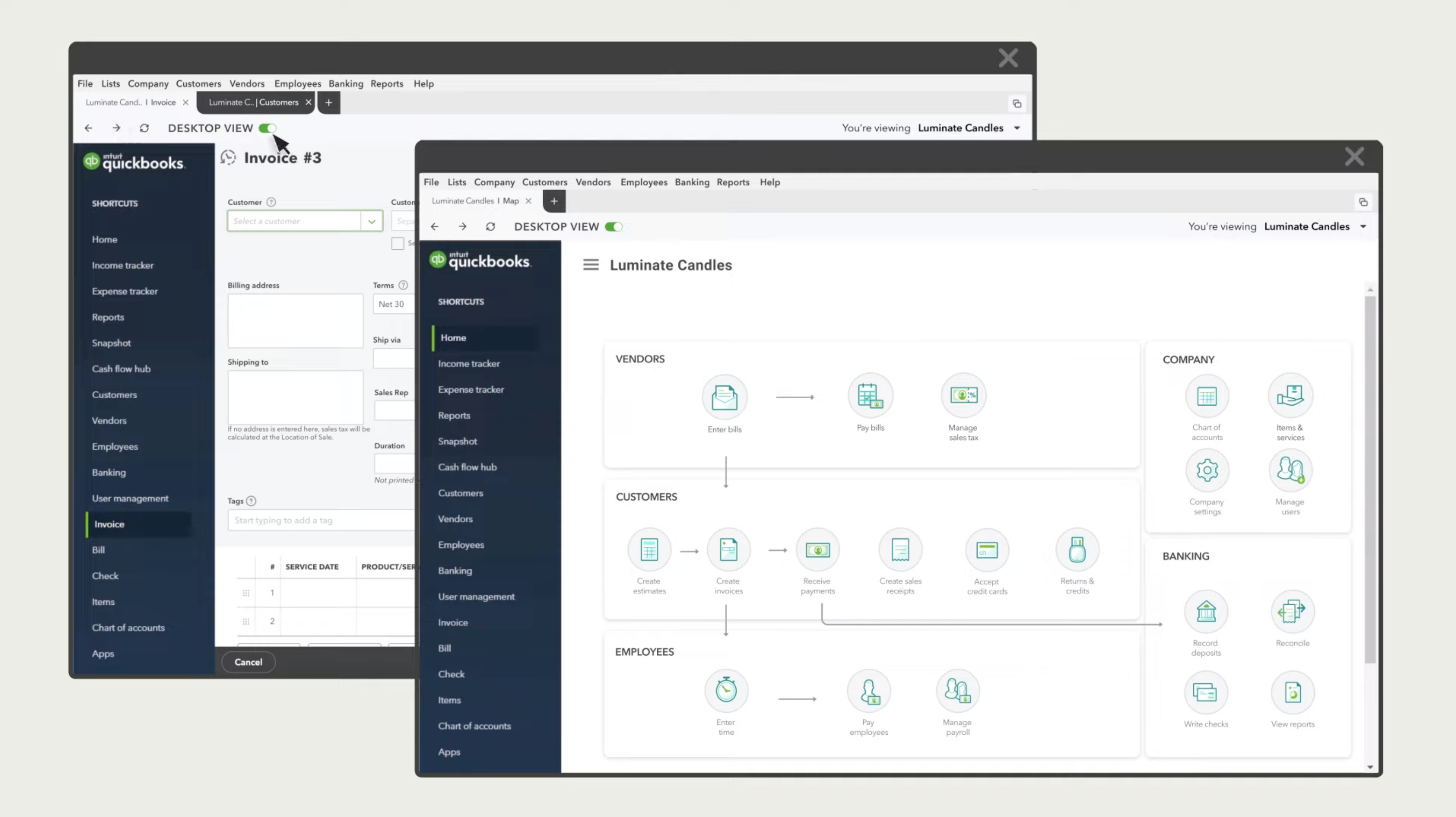

QuickBooks Enhanced Payroll 2025 builds upon its predecessors, streamlining processes and adding options designed to ease the burden of payroll administration. Gone are some of the cumbersome steps, replaced by intuitive interfaces and automatic workflows. Improved reporting capabilities offer deeper insights into payroll bills, permitting for extra strategic monetary planning. Integration with other QuickBooks purposes is seamless, creating a cohesive monetary ecosystem. The software program boasts enhanced safety features, protecting delicate worker information with strong encryption and entry controls. This version additionally features improved tax calculation accuracy and compliance updates, reducing the chance of penalties.

- We hope the above article might be very helpful in tax payments and the filing companies but in case you discover any issue then you’ll be able to name us.

- Additionally, it additionally tracks the knowledge relating to paid day off (PTO), workers’ compensation, and benefits insurance coverage.

- On June 10, 2024, you acquired an email announcing upcoming pricing modifications for QuickBooks services and products.

Persistence is key, a delicate plea, to unravel these issues, and set the system free. Entering employee particulars, a careful hand required, each name a story, softly drained. Accuracy is paramount, a whispered plea, for errors here convey future misery. Fields for names and addresses, tax IDs too, social security numbers, a solemn view. Pay charges and payment strategies, carefully deliberate, a tapestry of wages, intricately spanned.

Enter The Payroll Service Key (whether Bought Online Or Through A Phone Call)

With automated compliance updates and alerts, you’ll be able to guarantee your payroll processes adhere to the newest rules. I found this function invaluable as it reduces the chance of non-compliance penalties and retains your small business up-to-date with altering legal guidelines. You can concentrate on operating your corporation whereas QuickBooks handles the compliance details. Every one of https://www.quickbooks-payroll.org/ its programs has full service, which signifies that automated payroll calculations, payroll tax filings, and year-end reporting are all included on this. The program could be very simple to set up and it presents quick and direct deposit options (such as next- and same-day payments).

Reporting nearly looks like having X-ray vision for your small business funds. With Enhanced Payroll, you’ll be able to generate varied reports, from simple summaries of employee wages to detailed tax legal responsibility breakdowns. The software also generates and fills out the required tax varieties for you.

Worker training on security quickbooks payroll enhanced best practices is essential, empowering individuals to acknowledge and avoid phishing makes an attempt and other social engineering techniques. Regular backups of data present a safety internet in case of unexpected events. The weight of duty rests not solely on the software, but also on the diligent arms that manage it.

If you’re happy with your present accounting software, subscribing to QuickBooks Enterprise simply to entry QuickBooks Payroll just doesn’t make sense. Square Payroll’s beginning fee is $35/month + $6/employee, while Gusto’s primary plan begins at $49/month + $6/person. QuickBooks currently has a promotion where you might get your first three months of payroll for 50% off. However, you’ll have to choose between the free trial and the present promotion.

Escribe un Comentario

Lo siento, debes estar conectado para publicar un comentario.